IJNSA O3

A SYSTEMATIC REVIEW OF APPLICATIONS INFRAUD DETECTION

Hashim Jameel Shareef Jarrar

Department of Cybersecurity, College of Information Technology, Middle East University,

Amman, Jordan

ABSTRACT

The following systematic review aims to investigate the applications of data science techniques for frauddetection (FD),especially Machine Learning (ML),Deep Learning (DL), and the combination of both techniques in different domains, includingcredit card fraud and cyber (online) fraud. The increasing sophistication of fraudulent activities necessitates advanced detectionmethods, as traditional rule-based techniques often fall short. The review involves articles from 2022 to 2024, establishingvarious algorithms and techniques’ efficiency. Some of the research findings show that the most frequently used FD algorithmsare supervised ML algorithms like logistic regression, decision trees, and random forests, which have high accuracy. Also, DLtechniques especially Long Short-Term Memory (LSTM) networks and convolutional neural networks (CNNs), have beenreported to provide better results, especially in real-world problems, including e-commerce and online web-based FD. Some ofthe new trends that are increasingly being incorporated to improve FD capabilities are the hybrid models that integrate ML anDL methods. However, there are still some limitations associated with the use of ML for FD, such as class imbalance,interpretability of the trained model, and the evolving nature of fraud tactics. The review discusses the current trends, includingreal-time detection and the use of AI in FD systems; the review also provides further research directions for overcoming thechallenges and improving the performance of FD systems. Overall, this review contributes to the growing body of knowledge inFD and emphasizes the importance of continuous innovation in data science applications.

KEYWORDS

Data Science; Machine Learning; Deep Learning; Fraud Detection; Cyber Fraud

1. INTRODUCTION

Fraud detection (FD) has become a critical issue in various industries, including finance, e-commerce, and

cybercrimes, due to the increasing prevalence of fraudulent activities and the associated financial andreputationallosses(Al-Hashedi & Magalingam, 2021). Traditional rule-based and anomaly detection techniques provenin effectiveinaddressingmodernfraudschemes’complexityandsophistication(Benedek & Nagy, 2023). However,the rapid advancements in datascience, particularly in the fields of machine learning (ML), deep learning (DL), andartificial intelligence (AI) have revolutionized the way FD is approached. Data science techniques offer powerfultools for analyzing large volumes of data, identifying patterns, and detecting anomalies that may indicate fraudulentbehavior. These techniques have been widely applied in various FD domains, such as credit card fraud and cyber(online) fraud (Abed & Fernando, 2023; Patel, 2023). The application of data science in FD has gained significantattention in recent years, with numerous studies exploring the effectiveness of different algorithms and techniques.According to the Nilson Report, global CCF losses have steadily increased, reaching $28.65 billion in 2021. Thisrepresents a 10% increase from 2020 (Sinčák, 2023). The shift towards online and card-not-present (CNP)transactions has increased the risk of CCF, as it is more difficult to verify the cardholder’s authenticity(Abed &Fernando, 2023). In Europe, CCF fell to its lowest level (0.028%) in 2021, driven by the implementation of robustcustomer authentication measures(Fatih, 2023). However, the UK continues to have the highest fraudster rates inEurope, with over £1.2 billion stolen via authorized and unauthorized activities in 2022(Saghir & Kafteranis,2022).Globally, businesses in e-commerce, small businesses, and high-risk industries are particularly vulnerable toCCF. CCF includes stolen/lost cards, CNP fraud, account takeover, application fraud, skimming, andphishing/vishing scams. Ongoing vigilance and adopting advanced data science techniques are crucial to combat theevolving nature of CCF worldwide(Nicolini & Leonelli, 2021).

Furthermore, insurance fraud is also a growing global problem, with over 60% of surveyed insurers reporting asignificant increase in fraud incidents over the past two years(Saddi et al., 2024). The financial impact is staggering,with healthcare fraud alone costing an estimated $105 billion annually in the US(Ashley Kilroy, 2024). Commoninsurance fraud schemes include false injuries, non-disclosure of relevant information, staged accidents, andfraudulent billing. Emerging trends indicate increased data theft, collusion between third parties, and mis-sellinginsurance products. Fraudsters are also taking advantage of the shift towards digitalization, tampering withelectronic claims evidence. To combat this, insurers invest in advanced analytics and anti-fraud technologies likepredictive modeling and link analysis(O’Brien, 2021). However, most insurers plan to maintain the same level ofinvestment in fraud risk management, raising concerns about the effectiveness of current controls. Ongoingvigilance and collaboration between insurers, regulators, and law enforcement are crucial to stay ahead of evolving

fraud tactics worldwide(Nalluri et al., 2023).

In 2023, the Federal Trade Commission received over one million reports of identity theft, with CCF being the mostcommon type. Identity theft reports declined from 2022 but remained well above pre-pandemic levels. Fraudstersincreasingly use sophisticated techniques like synthetic identity theft, which leverages AI to create fakeidentities. This type of fraud is estimated to cost lenders nearly $3 billion annually(Mitchell, 2023). Cybercriminalsalso target specific personal data in data breaches, leading to a surge in breaches despite a decliningnumber ofaffected individuals.CCF remains a significant issue, with lost or stolen cards accounting for most ATM and pointof-sale fraud(Berg & Hansen, 2020; Btoush et al., 2023). Ongoing vigilance and advanced FD technologies arecrucial to combat these evolving threats.

This systematic review aims to comprehensively analyze the current research on data science applications indifferent FDs. By integrating the findings from relevant studies published between 2022 and 2024, this review seeksto identify the most effective techniques, highlight emerging trends, and uncover research gaps that warrant furtherinvestigation.

1. RESEARCH METHODOLOGY

A thorough analysis of this systematic review’s working and reporting processes adhered to the Preferred ReportingItems for Systematic Reviews and Meta-Analyses (PRISMA) criteria statement(Page et al., 2021). Furthermore, noformal ethical review or informed consent was required because this was a review of already published studies.

2.1. Searching Strategy

We developed a search strategy for this systematic research to identify relevant literature. The search strategyinvolved querying multiple electronic databases and web search engines, including Scopus, ACM Digital Library,Web of Science, ScienceDirect, IEEE Xplore, Google Scholar, Semantic Scholar, and JSTOR for relevant articlespublished between January 2020 and May 2024. The search terms used were: (“data science” OR “machinelearning” OR “deep learning”) AND (“fraud detection” OR “fraud prevention” OR “anomaly detection” OR “creditcard fraud” OR “online fraud” OR “web-based fraud” OR “cyber fraud”)

Figure 1. PRISMA flow diagram for the systematic review of data Science applications in fraud detection.

2.2. Inclusion Criteria

Articles published in peer-reviewed journals or conference proceedings.

Articles focusing on the application of data science techniques in FD.

Articles focusing on only CCF, online fraud, and cyber fraud.

Articles published between 2022-2024.

Articles published in English.

2.3. Exclusion Criteria

Articles published before January 2022 or after June 2024.

Articles not accessible in full-text format.

Articles not relevant to the scope of the review.

2.4. Data Collection and Extraction

The initial search yielded 4,555 articles. After removing duplicates and applying the inclusion and exclusion criteria,736 articles were selected for full-text screening. Of these, 88 articles were deemed eligible for inclusion in thereview.The data extraction process involved recording the following information for each included article: authornames, publication year, journal or conference name, FD domain, data science techniques used, performancemetrics, and key findings. The extracted data was organized in a spreadsheet for further analysis.

3. RESULTS

The current systematic review identified a wide range of data science techniques applied in FD (CCF and cyber(online) fraud), including ML algorithms, DL techniques, and hybrid approaches (Table 2). The most commonlyused techniques were based on supervised learning algorithms, such as logistic regression (LR), decision trees (DT),and random forests (RT), which were applied in various FD domains, including CCF and cyber (online) fraud.Moreover, unsupervised learning algorithms, such as clustering and anomaly detection techniques, were used toidentify suspicious patterns and outliers in financial transactions and CCFs. Furthermore, DL architectures, such asartificial neural networks (ANN) and convolutional neural networks (CNN), demonstrated superior performance incomplex FD tasks, particularly in the e-commerce and cyber domain (Btoush et al., 2023; Priscilla & Prabha, 2020).

3.1. Credit Card Fraud Detection

Credit card fraud detection (CCFD) is the technique of categorizing fraudulent transactions as real or fraudulent. Theidentification of fraudulent activity on a credit card can be accomplished by analyzing the cardholder’s spendingpatterns. Various ML, DL, and AI models have been used for the efficient CCFD. Figure 2 shows the number ofstudies on CCFD in respective years using ML, DL, and AI techniques.

Figure 1. Credit card fraud detection studies during the year 2022-2024

3.2. ML Techniques in CCFD

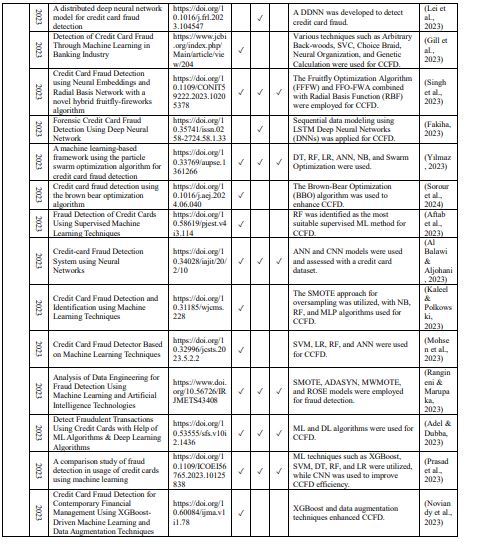

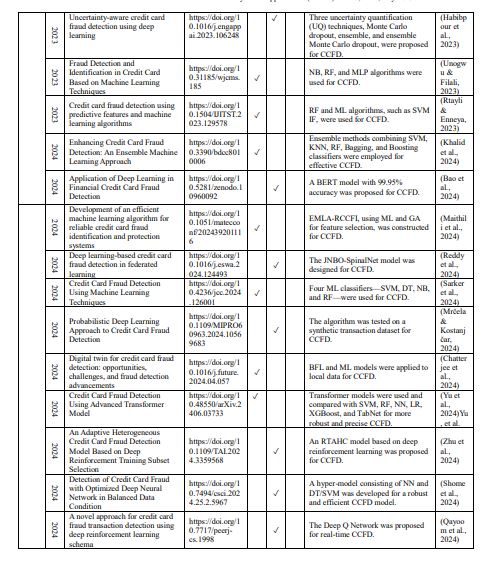

Several studies have utilized ML algorithms for CCFD (Table 1). Alarfaj et al. (2022) employed various ML and DLalgorithms, achieving high accuracy rates (Alarfaj et al., 2022). Qaddoura&Biltawi (2022) improved FD inimbalanced data using oversampling techniques (Qaddoura & Biltawi, 2022). Roseline et al. (2022) used a LongShort-Term Memory (LSTM) Recurrent Neural Network (LSTM-RNN) (Roseline et al., 2022). Jovanovic et al.(2022) tuned ML models using a Group Search Firefly Algorithm (Jovanovic et al., 2022). Khan et al. (2022)developed a CCFD model using logistic regression, artificial neural networks, and support vector machines (Khan etal., 2022).Several studies employed ensemble methods, e.g., Sahithi et al. (2022) proposed a predictive classification modelusing ensemble techniques (Sahithi et al., 2022), and Karthik et al. (2022) combined boosting and bagging forCCFD (Karthik et al., 2022). Khalid et al. (2024) ensembled SVM, KNN, RF, Bagging, and Boosting classifiers(Khalid et al., 2024). Feature engineering techniques were also explored. Kaleel & Polkowski (2023) used SMOTEoversampling with NB, RF, and MLP (Kaleel & Polkowski, 2023), and Noviandy et al. (2023) combined XGBoostwith data augmentation (Noviandy et al., 2023). Maithili et al. (2024) used ML with Genetic Algorithm (GA) featureselection (Maithili et al., 2024).3.3. DL Techniques in CCFDSome studies utilized DL algorithms for CCFD (Table 1). Alarfaj et al. (2022) employed DL along with ML.Roseline et al. (2022) used an LSTMRNN (Roseline et al., 2022). Fakiha (2023) employed LSTM_DNNs (Fakiha,2023). Bao et al. (2024) proposed a BERT model with 99.95% accuracy (Bao et al., 2024). Reddy et al. (2024)designed a JNBO-SpinalNet model. Yu et al. (2024) used Transformer models (Reddy et al., 2024).

3.4. Hybrid Techniques in CCFD

Several studies combined ML and DL techniques for CCFD (Table 1). Alarfaj et al. (2022) used a hybrid approach(Alarfaj et al., 2022). Roseline et al. (2022) employed an LSTM-RNN (Roseline et al., 2022). Esenogho et al. (2022)combined SMOTE-ENN with a boosted LSTM (Esenogho et al., 2022). Singh et al. (2023) used a hybrid FruitflyFireworks algorithm with RBF (Singh et al., 2023). Reddy et al. (2024) designed a JNBO-SpinalNet model (Reddyet al., 2024). Yu et al. (2024) used Transformer models and other ML algorithms (Yu et al., 2024). The reviewedstudies highlighted several challenges and limitations in applying data science techniques for CCFD. These include

class imbalance (Aftab et al., 2023; Esenogho et al., 2022; Qaddoura & Biltawi, 2022), feature engineering (Cheahet al., 2023; Esenogho et al., 2022; Khan et al., 2022; Rangineni & Marupaka, 2023), and interpretability of complexmodels (Gill et al., 2023; Singh et al., 2023; Yılmaz, 2023).

Table 1. Data Science tools and models are used for Credit card fraud detection

Table 1. International Journal of Network Security & Its Applications (IJNSA) Vol.17, No.4, July 2025

Table 1. International Journal of Network Security & Its Applications (IJNSA) Vol.17, No.4, July 2025

Table 1. International Journal of Network Security & Its Applications (IJNSA) Vol.17, No.4, July 2025

Table 1. Advantages and Disadvantages of Different ML/ DL and AI approaches in CCFD

Table 1. International Journal of Network Security & Its Applications (IJNSA) Vol.17, No.4, July 2025

Table 1. International Journal of Network Security & Its Applications (IJNSA) Vol.17, No.4, July 2025

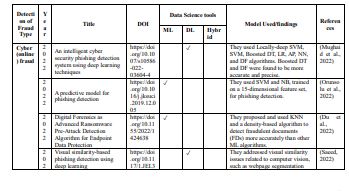

3.5. Cyber (Online) Fraud Detection

Traditional cyber fraud detection (CFD) methods are becoming inadequate due to the evolving nature of cyberthreats. ML and artificial intelligence have emerged as promising technologies for improving detection capabilities.Over time, they can learn from data to adapt to new threats(Cao et al., 2024). Some key ways AI and ML are usedfor CFD include proactive threat detection, real-time analysis, anomaly detection, threat intelligence analysis, andbehavior-based analysis. Proactive detection uses patterns in logs and traffic to find subtle threats, including zerodays. Real-time analysis allows machines to rapidly process large data volumes, improving response times(Btoush etal., 2023).Anomaly detection sets up standard patterns and alerts on potential intrusions to the system. Threat intelligenceanalysis is a way of combining information gathered internally and externally in order to look for patterns andpotential attacks. Behavioral analysis techniques focus on how an entity communicates with the networks to identifyinsiders or the movement of the threats. Both AI and ML are also used to detect malware. It can teach them newpatterns and codes to detect the new strains of malware, such as polymorphic and file-less malware, that are hard todetect by signature-based tools. Such threats are easily identifiable by the ML algorithms even when other methodsare not useful. The second major application involves the ability to respond to an incident automatically. AI canautomate response workflows to contain infected systems, stop communication with the source, and startinvestigations. This decreases the workload of security personnel while guaranteeing prompt and uniform responsesthat contain the impact of threats (Barraclough et al., 2021; Minastireanu & Mesnita, 2019).

Table 1. Table 3. Data Science tools and models are used for Credit card fraud detection

table 1. International Journal of Network Security & Its Applications (IJNSA) Vol.17, No.4, July 2025

table 1. International Journal of Network Security & Its Applications (IJNSA) Vol.17, No.4, July 2025

table 1. International Journal of Network Security & Its Applications (IJNSA) Vol.17, No.4, July 2025

3.6. Machine Learning Techniques in CFD

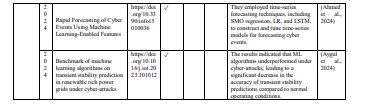

Several studies have utilized ML algorithms for cyber and online fraud detection. Mughaid et al. (2022) usedLocally-deep SVM, SVM, Boosted DT, LR, AP, NN, and DF algorithms, finding Boosted DT and DF to be moreaccurate and precise for phishing detection. Orunsolu et al. (2022) used SVM and NB trained on a 15-dimensionalfeature set for phishing detection. Du et al. (2022) proposed and used KNN and density-based algorithms to detectransomware more accurately than other ML algorithms. Aljabri& Mohammad (2023) applied ML models todetermine whether a website visitor is human or bot to detect pay-per-click online fraud. Valavan & Rita (2023)used ML algorithms such as DT, RF, LR, and GB for fraud detection and prediction. Sharma & Babbar (2023)found XGBoost to have the best accuracy at 98%, followed by AdaBoost and RF, for cryptocurrency frauddetection. Vanini et al. (2023) used an ML triage model for online payment fraud, reducing expected losses by 52%.Almazroi& Ayub (2023) used the Jaya optimization algorithm (RXT-J) for online payment fraud detection. Dineshet al. (2023) used RF, XGBoost, and LR for phishing website detection. Tamal et al. (2024) evaluated and compared15 supervised ML algorithms and ensembles for phishing attack detection. Labu & Ahammed (2024) used Feedzai’sAI-based software and RF algorithms for real-time fraud detection in financial institutions. Chhabra Roy and coworkers (2024) used ML-based data analysis with self-organizing maps to dynamically and in real-time assess theseverity of cyber fraud. Inuwa & Das (2024) performed a comparative analysis of ML techniques, including SVM,ANN, DT, LR, and KNN, finding neural networks performed better than other models for anomaly detection in IoTnetwork cyber-attacks.Cao et al. (2024) used SVM and KNN models for cybercrime detection, with SVM achieving a 91% accuracy rate.Ortiz-Ruiz et al. (2024) used LR, NB, and KNN algorithms for cyberattack prevention in Colombia’s IoTinfrastructure. Omer et al. (2024) proposed and compared PSO-SVM with other approaches, such as KNN, DT, andANN, achieving better results with PCO-SVM for cybersecurity threat detection. Nabi & Zhou (2024) usedfivepopular classification algorithms, finding the J48 algorithm attained a relatively good accuracy of 79.1% forintrusion detection system enhancement through dimensionality reduction. Adekunle et al. (2024) used theDensenet201 model to categorize attacks across various IoT security datasets. Ahmed et al. (2024) used time-series

forecasting techniques, including SMOreg, LR, and LSTM, to forecast cyber events. Aygul et al. (2024) found thatunder cyber-attacks, ML algorithms underperform, leading to a significant decrease in the accuracy of transientstability predictions in renewable-rich power grids.3.7. Deep Learning Techniques in CFDSome studies utilized DL algorithms for cyber and online fraud detection. Saeed (2022) used visual similarity-baseddeep learning for phishing detection, which raises several computer vision-related issues. Udayakumar et al. (2023)used a DFN to effectively detect and categorize instances of fraudulent behavior with reduced misclassifications.Uyyala& Yadav (2023) used a GAN-based Anti-fraud-Tensorlink4cheque (AFTL4C) solution for real-time frauddetection. Shetty &Malghan (2023) used DL techniques and ANN to detect complex fraud patterns, while LR wa

typical of the probability of fraudulent events. Tenis & Santhosh (2023) compared various DL models and achievedthe greatest accuracy of 99.18% using an adaptive Recurrent Neural Networks model for phishing website detection.Xu et al. (2023) designed the grouped trees and weighted ensemble algorithm (GTWE) for fraud detection in onlineloan applications. Zhao et al. (2024) designed and used self-attention generative adversarial networks(SAGANs) todetectCCF. Kumar et al. (2024) focused on developing a DL anti-fraud ANN model for Internet loan applications.Meduri (2024) used modern ML algorithms to reduce cybersecurity threats and ensure the security of digitaltransactions within the banking industry.

table 1.Figure 3. Cyber (online) fraud detection studies in each year.

4. DISCUSSION

The review highlights the effectiveness of various data science techniques in detecting fraudulent activities. MLalgorithms, particularly supervised learning methods, have been widely adopted due to their ability to learn fromhistorical data and make predictions on unseen instances. Studies have shown that algorithms such as LR, DTs, RFs,and SVMs are commonly employed in fraud detection tasks. For example, Alarfaj et al. (2022) demonstrated that acombination of ML and DL algorithms significantly improved the accuracy of CCFD. DL techniques have alsogained traction, particularly in complex fraud detection scenarios where traditional methods may fall short. Theability of deep learning models, such as LSTM networks and CNNs, to capture intricate patterns in large datasetshas proven beneficial in domains like e-commerce and cyber (online) fraud detection(Alarfaj et al., 2022). Forinstance, Fakiha (2023) employed LSTM networks for sequential data modeling, achieving impressive results indetecting fraudulent transactions. Hybrid approaches combining ML and DL techniques have emerged as apromising avenue for enhancing fraud detection capabilities. By leveraging the strengths of both methodologies,

researchers have developed models that can effectively handle diverse fraud scenarios(Fakiha, 2023). For example,Singh et al. (2023) utilized a hybrid Fruitfully-Fireworks algorithm with radial basis function networks, achievingsuperior performance in CCFD(Singh et al., 2023).

4.1. Challenges in Fraud Detection

Despite the advancements in data science techniques, several challenges persist in the realm of FD. Among the mostpressing problems, one can mention the class imbalance problem, in which fraudulent instances may be much fewerthan legitimate transactions. Such an imbalance can result in skewed models favoring the perpetrators of fraud inthat their fraudulent activities are not detected. Other previous works, for instance, Aftab et al., 2023, andQaddoura&Biltawi, 2022, have proposed oversampling and synthetic data generation to overcome this problem,while there is a need for more research in this area. Another issue is the explainability of intricate models. Indeed,deep learning algorithms can provide very accurate results, but at the same time, they are ‘black boxes,’ thus notallowing the stakeholders to understand the decision-making process. Such lack of transparency is detrimental to themodels in terms of trust and the subsequent incorporation of the models into practical use (Aftab et al., 2023;Qaddoura & Biltawi, 2022). As Gill et al. (2023) and Singh et al. (2023) have pointed out, investing in methods thatwould improve the explainability of AI models and boost people’s trust is crucial. Also, the dynamic nature of fraudschemes constitutes a threat to detection systems, as fraudsters quickly develop new strategies (Gill et al., 2023;

0510152025No. of Studies2022 2023 2024International Journal of Network Security & Its Applications (IJNSA) Vol.17, No.4, July 202547Singh et al., 2023). There is always an evolution in the fraudster tactics, meaning the models must be updated andretrained frequently. The constantly evolving nature of fraud means that it is necessary to have algorithms capable oflearning from new data and updating their models.

4.2. Emerging Trends

The review also outlines several trends noted in the literature on FD. Another trend is using AI methods, includingreinforcement learning and GANs, in FD systems, for example. These techniques are more sophisticated andprovide new ways of dealing with complicated fraud cases and increasing the efficiency of the detection process.For example, GANs, in the case of data generation, can be used to solve problems associated with class imbalanceand improve model training. Another trend is the increasing interest in real-time FD. Due to the growth of Internettransactions, the need to have real-time detection tools for fraud has become crucial. Scholars are investigating waysof creating models that can process the transaction information in real-time and give real-time alarms for anyunlawful activities. This change in real-time detection aligns with the growing demand of consumers and businesses

for quick responses to fraud

Moreover, it is also evident that there is a focus on the cooperation of different players, such as financial institutions,regulatory bodies, and technology solutions to fight fraud effectively. It is also important to note that joint projectscan result in the exchange of information and, therefore, increase the efficiency of FD systems. This approach isespecially suitable for cyber fraud because the systems are interconnected, and a coordinated response should beprovided to new threats.

4.3. Future Research Directions

The findings of this review highlight several areas for future research in FD. Firstly, there is a lack of sufficientresearch that compares the effectiveness of the various algorithms used in the different fraud domains. Crosssectional studies can be useful because they illustrate the advantages and disadvantages of particular methodologies,which can help practitionerschoose the right techniques for their work. Secondly, future studies should be directedtoward creating mixed models, which will enhance the features of the ML and the DL approaches and minimizetheir drawbacks, such as the interpretability of the models and the problem of the imbalanced classes. The measuresthat will be valuable for building trust with stakeholders will be the new strategies that help increase modelinterpretability and give reasons for the output data. Furthermore, the further study of FD systems’ integration with

advanced technologies like blockchain and federated learning remains relevant. Blockchain helps secure andimprove data quality, while federated learning helps train models without sharing the data. Studying thesetechnologies’ prospects can inform the development of more effective and secure FD solutions. Finally, the effectsof the regulatory changes and changes in the consumers’ behaviours regarding FD practices should be explored.Given the dynamic nature of rules regarding data privacy and security, researchers need to determine how thesechanges impact FD strategies and the implementation of new technologies.

5. CONCLUSION

This systematic review aims to present the findings of a scoping of the current state of research on data scienceapplications in FD. The study also shows the possibility of applying ML and DL methods to improve FDperformance in different fields. However, the review also points to issues that have to do with these techniques andtheir drawbacks, such as data imbalance, lack of labeled data, and interpretability of intricate models. The reviewalso reinforces the need to include domain knowledge and context alongside traditional data science and machinelearning paradigms and the possibility of integrating two or more approaches. Potential areas for future researchinclude the study of federated learning, methods aimed at preserving privacy, and the development of explainableAI. The knowledge derived from this review can help researchers and practitioners design improved and efficientFD systems that employ data science approaches. The future of data science-based FD can be further developed byaddressing the identified challenges and focusing on the discussed trends, thus helping establish a safer environmentfor businesses and consumers.

DECLARATIONS

All authors declare that they have no conflicts of interest.

REFERENCES

[1] Abed, M., & Fernando, B. (2023). E-commerce fraud detection based on machine learning techniques: Systematic literature review. BigData Min. Anal.

[2] Adekunle, T. S., Alabi, O. O., Lawrence, M. O., Adeleke, T. A., Afolabi, O. S., Ebong, G. N., Egbedokun, G. O., & Bamisaye, T. A. (2024).An intrusion system for internet of things security breaches using machine learning techniques. Artificial Intelligence and Applications,

[3] Adel, M., & Dubba, N. M. (2023). Detect Fraudulent Transactions Using Credit Cards with Help of ML Algorithms & Deep LearningAlgorithms. Journal of Survey in Fisheries Sciences, 829-834.

[4] Aftab, A., Shahzad, I., Anwar, M., Sajid, A., & Anwar, N. (2023). Fraud Detection of Credit Cards Using Supervised Machine Learning.Pak. J. Emerg. Sci. Technol. (PJEST), 4, 38-51.

[5] Ahmed, Y., Azad, M. A., & Asyhari, T. (2024). Rapid Forecasting of Cyber Events Using Machine Learning-Enabled Features.Information, 15(1), 36.

[6] Airlangga, G. (2024). Evaluating the Efficacy of Machine Learning Models in Credit CardFraudDetection. Journal of ComputerNetworks, Architecture and High-Performance Computing, 6(2), 829-837.

[7] Al-Fatlawi, A., Al-Khazaali, A. A. T., & Hasan, S. H. (2024). AI-based model for fraud detection in bank systems. Journal of Fusion:Practice and Applications, 14(1), 19-27.

[8] Al-Hashedi, K. G., & Magalingam, P. (2021). Financial fraud detection applying data mining techniques: A comprehensive review from2009 to 2019. Computer Science Review, 40, 100402.

[9] Al Balawi, S., & Aljohani, N. (2023). Credit-card fraud detection system using neural networks. Int. Arab J. Inf. Technol., 20(2), 234-241.[10] Alarfaj, F. K., Malik, I., Khan, H. U., Almusallam, N., Ramzan, M., & Ahmed, M. (2022). Credit card fraud detection using sta te-of-the-art

machine learning and deep learning algorithms. IEEE Access, 10, 39700-39715.

[11] Alharbi, A., Alshammari, M., Okon, O. D., Alabrah, A., Rauf, H. T., Alyami, H., & Meraj, T. (2022). A novel text2IMG mechanism ofcredit card fraud detection: A deep learning approach. Electronics, 11(5), 756.

[12] Alhashmi, A. A., Alashjaee, A. M., Darem, A. A., Alanazi, A. F., & Effghi, R. (2023). An ensemble-based fraud detection model forfinancial transaction cyber threat classification and countermeasures. Engineering, Technology & Applied Science Research, 13(6), 12433-12439.

[13] Ali, A. A., Khedr, A. M., El-Bannany, M., & Kanakkayil, S. (2023). A powerful predicting model for financial statement fraud based onoptimized XGBoost ensemble learning technique. Applied Sciences, 13(4), 2272.

[14] Aljabri, M., & Mohammad, R. M. A. (2023). Click fraud detection for online advertising using machine learning. Egyptian InformaticsJournal, 24(2), 341-350.

[15] Almazroi, A. A., & Ayub, N. (2023). Online Payment Fraud Detection Model Using Machine Learning Techniques. IEEE Access, 11,137188-137203.

[16] Arjunan, T. (2024). Fraud Detection in NoSQL Database Systems Using Advanced Machine Learning. International Journal of InnovativeScience and Research Technology(IJISRT), March, 13, 248-253.

[17] Ashley Kilroy. (2024, Mar 21, 2024). Insurance Fraud Statistics 2024. Forbes. Retrieved 28th June 2024 fromhttps://www.forbes.com/advisor/insurance/fraud-statistics/

[18] Aygul, K., Mohammadpourfard, M., Kesici, M., Kucuktezcan, F., & Genc, I. (2024). Benchmark of machine learning algorithms ontransient stability prediction in renewable rich power grids under cyber-attacks. Internet of Things, 25, 101012.

[19] Bao, Q., Wei, K., Xu, J., & Jiang, W. (2024). Application of Deep Learning in Financial Credit Card Fraud Detection. Journal of EconomicTheory and Business Management, 1(2), 51-57.

[20] Barraclough, P. A., Fehringer, G., & Woodward, J. (2021). Intelligent cyber-phishing detection foronline. computers & security, 104,102123.

[21] Benedek, B., & Nagy, B. Z. (2023). Traditional versus AI-Based Fraud Detection: Cost Efficiency in the Field of Automobile Financial and Economic Review, 22(2), 77-98.

[22] Berg, H. H., & Hansen, S. E. (2020). The stock market effect of Cybercriminals: an empirical study of the price effects on US listedcompanies targeted by a data breach

[23] Btoush, E. A. L. M., Zhou, X., Gururajan, R., Chan, K. C., Genrich, R., & Sankaran, P. (2023). A systematic review of literature on credit

card cyber fraud detection using machine and deep learning. PeerJ Computer Science, 9, e1278.

[24] Cao, D. M., Sayed, M. A., Islam, M. T., Mia, M. T., Ayon, E. H., Ghosh, B. P., Ray, R. K., & Raihan, A. (2024). Advanced cybercrimedetection: A comprehensive study on supervised and unsupervised machine learning approaches using real-world datasets. Journal ofComputer Science and Technology Studies, 6(1), 40-48.

[25] Chatterjee, P., Das, D., & Rawat, D. B. (2024). Digital twin for credit card fraud detection:Opportunities, challenges, and fraud detectionadvancements. Future Generation Computer Systems.

[26] Cheah, P. C. Y., Yang, Y., & Lee, B. G. (2023). Enhancing financial fraud detection through addressing class imbalance using hybridSMOTE-GAN techniques. International Journal of Financial Studies, 11(3), 110.

[27] Cherif, A., Ammar, H., Kalkatawi, M., Alshehri, S., & Imine, A. (2024). Encoder–decoder graph neural network for credit card frauddetection. Journal of King Saud University-Computer and Information Sciences, 36(3), 102003.

[28] Chhabra Roy, N., & P, S. (2024). Proactive cyber fraud response: a comprehensive framework from detection to mitigation in banks.Digital Policy, Regulation and Governance.

[29] Dinesh, P., Mukesh, M., Navaneethan, B., Sabeenian, R., Paramasivam, M., & Manjunathan, A. (2023). Identification of phishing attacksusing machine learning algorithm. E3S Web of Conferences,

[30] Du, J., Raza, S. H., Ahmad, M., Alam, I., Dar, S. H., & Habib, M. A. (2022). Digital Forensics as Advanced Ransomware Pre‐AttackDetection Algorithm for Endpoint Data Protection. Security and Communication Networks, 2022(1), 1424638.

[31] Duan, Y., Zhang, G., Wang, S., Peng, X., Ziqi, W., Mao, J., Wu, H., Jiang, X., & Wang, K. (2024). CaT-GNN: Enhancing Credit CardFraud Detection via Causal Temporal Graph Neural Networks. arXiv preprint arXiv:2402.14708.

[32] Emmanuel, D. U., Ali, J. G., Yakubu, B., Shidawa, A. B., Job, G. K., & Lawal, M. A. (2023). Machine Learning-Based Intrusion DetectionSystem for Cyber Attacks in Private and Public Organizations. International Journal, 12(5).

[33] Esenogho, E., Mienye, I. D., Swart, T. G., Aruleba, K., & Obaido, G. (2022). A neural network ensemble with feature engineering forimproved credit card fraud detection. IEEE Access, 10, 16400-16407.

[34] Fakiha, B. (2023). Forensic Credit Card Fraud Detection Using Deep Neural Network. Journal of Southwest Jiaotong University, 58(1).

[35] Fatih, C. (2023). Comparing machine learning algorithms on credit card fraud problem DublinBusiness School].

[36] Ferdous, F. S., Biswas, T., & Jony, A. I. (2024). Enhancing Cybersecurity: Machine Learning Approaches for Predicting DDoS Attack.Malaysian Journal of Science and Advanced Technology, 249-255.

[37] Gill, M. A., Quresh, M., Rasool, A., & Hassan, M. M. (2023). Detection of credit card fraud through machine learning in banking industry.Journal of Computing & Biomedical Informatics, 5(01), 273-282.

[38] Gongada, T. N., Agnihotri, A., Santosh, K., Ponnuswamy, V., Narendran, S., Sharma, T., & Baker El-Ebiary, Y. A. (2024). LeveragingMachine Learning for Enhanced Cyber Attack Detection and Defence in Big Data Management and Process Mining. International Journal

of Advanced Computer Science & Applications, 15(2).

[39] Habibpour, M., Gharoun, H., Mehdipour, M., Tajally, A., Asgharnezhad, H., Shamsi, A., Khosravi, A., & Nahavandi, S. (2023).Uncertainty-aware credit card fraud detection using deep learning. Engineering Applications of Artificial Intelligence, 123, 106248.

[40] Hajek, P., Abedin, M. Z., & Sivarajah, U. (2023). Fraud detection in mobile payment systems using an XGBoost-based framework.Information Systems Frontiers, 25(5), 1985-2003.

[41] Hasan, M. R., Gazi, M. S., & Gurung, N. (2024). Explainable AI in Credit Card Fraud Detection: Interpretable Models and TransparentDecision-making for Enhanced Trust and Compliance in the USA. Journal of Computer Science and Technology Studies, 6(2), 01-12.

[42] Huang, Z., Zheng, H., Li, C., & Che, C. (2024). Application of machine learning-based k-means clustering for financial fraud detection.Academic Journal of Science and Technology, 10(1), 33-39.

[43] Inuwa, M. M., & Das, R. (2024). A comparative analysis of various machine learning methods for anomaly detection in cyber attacks on

IoT networks. Internet of Things, 26, 101162.

[44] Jayaraj, R., Pushpalatha, A., Sangeetha, K., Kamaleshwar, T., Shree, S. U., & Damodaran, D. (2024). Intrusion detection based on phishingdetection with machine learning. Measurement: Sensors, 31, 101003.

[45] Jovanovic, D., Antonijevic, M., Stankovic, M., Zivkovic, M., Tanaskovic, M., & Bacanin, N. (2022). Tuning machine learning models

using a group search firefly algorithm for credit card fraud detection. Mathematics, 10(13), 2272.

[46] Kaleel, A., & Polkowski, Z. (2023). Credit Card Fraud Detection and Identification using Machine Learning Techniques. Wasit Journal of

Computer and Mathematics Science, 2(4), 159-165.

[47] Karthik, V., Mishra, A., & Reddy, U. S. (2022). Credit card fraud detection by modelling behaviour pattern using hybrid ensemble model.

Arabian Journal for Science and Engineering, 47(2), 1987-1997.

[48] Khalid, A. R., Owoh, N., Uthmani, O., Ashawa, M., Osamor, J., & Adejoh, J. (2024). Enhancing credit card fraud detection: an ensemble

machine learning approach. Big Data and Cognitive Computing, 8(1), 6.

[49] Khan, S., Alourani, A., Mishra, B., Ali, A., & Kamal, M. (2022). Developing a credit card fraud detection model using machine learning

approaches. International Journal of Advanced Computer Science and Applications, 13(3).

[50] Kumar, A. (2024). Cybersecurity Threat Detection using Machine Learning and Network Analysis. Journal of Artificial Intelligence

General science (JAIGS) ISSN: 3006-4023, 1(1), 124-131.

[51] Kumar, B. R. (2024). AI Based Credit Card Fraud Detection using Machine Learning Technique. 06(04).

[52] Kumar, S., Srija, K., Ramcharan, D., Jhansi, B., Bhavani, J., & Ganesh, L. (2024). Combatting Online Fraud: Advancing Fraud Detection

in Internet Loans through Deep Learning Innovations. RES MILITARIS, 14(4), 372-380.

[53] Labu, M. R., & Ahammed, M. F. (2024). Next-Generation cyber threat detection and mitigation strategies: a focus on artificial intelligence

and machine learning. Journal of Computer Science and Technology Studies, 6(1), 179-188.

[54] Lei, Y.-T., Ma, C.-Q., Ren, Y.-S., Chen, X.-Q., Narayan, S., & Huynh, A. N. Q. (2023). A distributed deep neural network model for credit

card fraud detection. Finance Research Letters, 58, 104547.

[55] Maithili, K., Kumar, T. S., Subha, R., Murthy, P. S., Sharath, M., Gupta, K. G., Ravuri, P., Madhuri, T., & Verma, V. (2024). Development

of an efficient machine learning algorithm for reliable credit card fraud identification and protection systems. MATEC Web of

Conferences,

[56] Meduri, K. (2024). Cybersecurity threats in banking: Unsupervised fraud detection analysis. International Journal of Science and Research

Archive, 11(2), 915-925.

[57] Minastireanu, E.-A., & Mesnita, G. (2019). An Analysis of the Most Used Machine Learning Algorithms for Online Fraud Detection.

Informatica Economica, 23(1).

[58] Ming, R., Abdelrahman, O., Innab, N., & Ibrahim, M. H. K. (2024). Enhancing fraud detection in auto insurance and credit card

transactions: a novel approach integrating CNNs and machine learning algorithms. PeerJ Computer Science, 10, e2088.

[59] Mitchell, C. (2023). Identity Theft Prediction Model using Historical Data and Supervised Machine Learning: Design Science Research

Study Colorado Technical University].

[60] Mohbey, K. K., Khan, M. Z., & Indian, A. (2022). Credit card fraud prediction using XGBoost: an ensemble learning approach.

International Journal of Information Retrieval Research (IJIRR), 12(2), 1-17.

[61] Mohsen, O. R., Nassreddine, G., & Massoud, M. (2023). Credit Card Fraud Detector Based on Machine Learning Techniques. Journal of

Computer Science and Technology Studies, 5(2), 16-30.

[62] Mrčela, L., & Kostanjčar, Z. (2024). Probabilistic Deep Learning Approach to Credit Card Fraud Detection. 2024 47th MIPRO ICT and

Electronics Convention (MIPRO),

[63] Mughaid, A., AlZu’bi, S., Hnaif, A., Taamneh, S., Alnajjar, A., & Elsoud, E. A. (2022). An intelligent cyber security phishing detection

system using deep learning techniques. Cluster Computing, 25(6), 3819-3828.

[64] Nabi, F., & Zhou, X. (2024). Enhancing intrusion detection systems through dimensio

[65] Nalluri, V., Chang, J.-R., Chen, L.-S., & Chen, J.-C. (2023). Building prediction models and discovering important factors of health

insurance fraud using machine learning methods. Journal of Ambient Intelligence and Humanized Computing, 14(7), 9607-9619.

[66] Nicolini, G., & Leonelli, L. (2021). Financial frauds on payment cards: The role of financial literacy and financial education.

INTERNATIONAL REVIEW OF FINANCIAL CONSUMERS.

[67] Noviandy, T. R., Idroes, G. M., Maulana, A., Hardi, I., Ringga, E. S., & Idroes, R. (2023). Credit card fraud detection for contemporary

financial management using xgboost-driven machine learning and data augmentation techniques. Indatu Journal of Management and

Accounting, 1(1), 29-35.

[68] O’Brien, S. (2021). The criminal act of committing insurance fraud: The challenges facing insurers when detecting and preventing

insurance fraud Dublin Business School].

[69] Omer, N., Samak, A. H., Taloba, A. I., El-Aziz, A., & Rasha, M. (2024). Cybersecurity Threats Detection Using Optimized Machine

Learning Frameworks. Computer Systems Science & Engineering, 48(1).

[70] Ortiz-Ruiz, E., Bermejo, J. R., Sicilia, J. A., & Bermejo, J. (2024). Machine Learning Techniques for Cyberattack Prevention in IoT

Systems: A Comparative Perspective of Cybersecurity and Cyberdefense in Colombia. Electronics, 13(5), 824.

[71] Orunsolu, A. A., Sodiya, A. S., & Akinwale, A. (2022). A predictive model for phishing detection. Journal of King Saud UniversityComputer and Information Sciences, 34(2), 232-247.

[72] Page, M. J., McKenzie, J. E., Bossuyt, P. M., Boutron, I., Hoffmann, T. C., Mulrow, C. D., Shamseer, L., Tetzlaff, J. M., Akl, E. A., &

Brennan, S. E. (2021). The PRISMA 2020 statement: an updated guideline for reporting systematic reviews. bmj, 372.

[73] Patel, K. (2023). Credit card analytics: a review of fraud detection and risk assessment techniques. International Journal of Computer

Trends and Technology, 71(10), 69-79.

[74] Prasad, P. Y., Chowdary, A. S., Bavitha, C., Mounisha, E., & Reethika, C. (2023). A comparison study of fraud detection in usage of credit

cards using machine learning. 2023 7th International Conference on Trends in Electronics and Informatics (ICOEI),

[75] Priscilla, C. V., & Prabha, D. P. (2020). Credit card fraud detection: A systematic review. Intelligent Computing Paradigm and Cutting-edge

Technologies: Proceedings of the First International Conference on Innovative Computing and Cutting-edge Technologies (ICICCT 2019),

Istanbul, Turkey, October 30-31, 2019 1,

[76] Qaddoura, R., & Biltawi, M. M. (2022). Improving fraud detection in an imbalanced class distribution using different oversampling

techniques. 2022 International Engineering Conference on Electrical, Energy, and Artificial Intelligence (EICEEAI),

[77] Qayoom, A., Khuhro, M. A., Kumar, K., Waqas, M., Saeed, U., ur Rehman, S., Wu, Y., & Wang, S. (2024). A novel approach for credit

card fraud transaction detection using deep reinforcement learning scheme. PeerJ Computer Science, 10, e1998.

[78] Rangineni, S., & Marupaka, D. (2023). Analysis of data engineering for fraud detection using machine learning and artificial intelligence

technologies. International Research Journal of Modernization in Engineering Technology and Science, 5(7), 2137-2146.

[79] Reddy, V. V. K., Reddy, R. V. K., Munaga, M. S. K., Karnam, B., Maddila, S. K., & Kolli, C. S. (2024). Deep learning-based credit card

fraud detection in federated learning. Expert Systems with Applications, 124493.

[80] Roseline, J. F., Naidu, G., Pandi, V. S., alias Rajasree, S. A., & Mageswari, N. (2022). Autonomous credit card fraud detection using

machine learning approach☆. Computers and Electrical Engineering, 102, 108132.

[81] Rtayli, N., & Enneya, N. (2023). Credit card fraud detection using predictive features and machine learning algorithms. International

Journal of Internet Technology and Secured Transactions, 13(2), 159-176.

[82] Saddi, V. R., Boddu, S., Gnanapa, B., Jiwani, N., & Kiruthiga, T. (2024). Leveraging Big Data and AI for Predictive Analysis in Insurance

Fraud Detection. 2024 International Conference on Integrated Circuits and Communication Systems (ICICACS),

[83] Saeed, U. (2022). Visual similarity-based phishing detection using deep learning. Journal of Electronic Imaging, 31(5), 051607-051607.

[84] Saeed, V. A., & Abdulazeez, A. M. (2024). Credit Card Fraud Detection using KNN, Random Forest and Logistic Regression Algorithms:

A Comparative Analysis. Indonesian Journal of Computer Science, 13(1).

[85] Saghir, W., & Kafteranis, D. (2022). The Applicable Law on Digital Fraud. In Finance, Law, and the Crisis of COVID-19: An

Interdisciplinary Perspective (pp. 221-235). Springer.

[86] Saheed, Y. K., Baba, U. A., & Raji, M. A. (2022). Big data analytics for credit card fraud detection using supervised machine learning

models. In Big data analytics in the insurance market (pp. 31-56). Emerald Publishing Limited.

[87] Sahithi, G. L., Roshmi, V., Sameera, Y. V., & Pradeepini, G. (2022). Credit card fraud detection using ensemble methods in machine

learning. 2022 6th International Conference on Trends in Electronics and Informatics (ICOEI).

[88] Sarker, A., Yasmin, M. A., Rahman, M. A., Rashid, M. H. O., & Roy, B. R. (2024). Credit Card Fraud Detection Using Machine Learning

Techniques. Journal of Computer and Communications, 12(6), 1-11.

[89] Sharma, A., & Babbar, H. (2023). Machine Learning-Driven Detection and Prevention of Cryptocurrency Fraud. 2023 International

Conference on Research Methodologies in Knowledge Management, Artificial Intelligence and Telecommunication Engineering

(RMKMATE),

[90] Shetty, V. R., & Malghan, R. L. (2023). Safeguarding against cyber threats: machine learning-based approaches for real-time fraud

detection and prevention. Engineering Proceedings, 59(1), 111.

[91] Shome, N., Sarkar, D. D., Kashyap, R., & Lasker, R. H. (2024). Detection of Credit Card Fraud with Optimized Deep Neural Network in

Balanced Data Condition. Computer Science, 25(2).

[92] Sinčák, J. (2023). Machine Learning Methods in Payment Card Fraud Detection.

[93] Singh, I., Aditya, N., Srivastava, P., Mittal, S., Mittal, T., & Surin, N. V. (2023). Credit Card Fraud Detection using Neural Embeddings and

Radial Basis Network with a novel hybrid fruitfly-fireworks algorithm. 2023 3rd International Conference on Intelligent Technologies

(CONIT),

[94] Sorour, S. E., AlBarrak, K. M., Abohany, A. A., & Abd El-Mageed, A. A. (2024). Credit card fraud detection using the brown bear

optimization algorithm. Alexandria Engineering Journal, 104, 171-192.

[95] Tamal, M. A., Islam, M. K., Bhuiyan, T., Sattar, A., & Prince, N. U. (2024). Unveiling suspicious phishing attacks: enhancing detection

with an optimal feature vectorization algorithm and supervised machine learning. Frontiers in Computer Science, 6, 1428013.

[96] Tenis, A., & Santhosh, R. (2023). Modelling of an Adaptive Network Model for Phishing Website Detection Using Learning Approa ches.

Full Length Article, 12(2), 159-159-171.

[97] Udayakumar, R., Joshi, A., Boomiga, S., & Sugumar, R. (2023). Deep Fraud Net: A Deep Learning Approach for Cyber Security and

Financial Fraud Detection and Classification. Journal of Internet Services and Information Security, 13(3), 138-157.

[98] Unogwu, O. J., & Filali, Y. (2023). Fraud detection and identification in credit card based on machine learning techniques. Wasit Journal of

Computer and Mathematics Science, 2(3), 16-22.

[99] Uyyala, P., & Yadav, D. C. (2023). The advanced proprietary AI/ML solution as Anti-fraudTensorlink4cheque (AFTL4C) for Cheque fraud

detection. The International journal of analytical and experimental modal analysis, 15(4), 1914-1921.

[100] Valavan, M., & Rita, S. (2023). Predictive-Analysis-based Machine Learning Model for Fraud Detection with Boosting Classifiers.

Computer Systems Science & Engineering, 45(1).

[101] Vanini, P., Rossi, S., Zvizdic, E., & Domenig, T. (2023). Online payment fraud: from anomaly detection to risk management. Financial

Innovation, 9(1), 66.

[102] Xu, M., Fu, Y., & Tian, B. (2023). An ensemble fraud detection approach for online loans based on application usage patterns. Journal of

Intelligent & Fuzzy Systems, 44(5), 7181-7194.

[103] Yılmaz, A. A. (2023). A machine learning-based framework using the particle swarm optimization algorithm for credit card fraud

detection. Communications Faculty of Sciences University of Ankara Series A2-A3 Physical Sciences and Engineering, 66(1), 82-94.

[104] Yu, C., Xu, Y., Cao, J., Zhang, Y., Jin, Y., & Zhu, M. (2024). Credit card fraud detection using advanced transformer model. arXiv preprint

arXiv:2406.03733.

[105] Zahid, S. Z. S., Muhammad, H. M. U. H. H., Hafeez, U., Iqbal, M. J. I. M. J., Asif, A. A. A., Yaqoob, S. Y. S., & Mehboob, F. M. F. (2024).

Credit Card Fraud Detection using Deep Learning and Machine Learning Algorithms. Journal of Innovative Computing and Emerging

Technologies, 4(1).

[106] Zhao, C., Sun, X., Wu, M., & Kang, L. (2024). Advancing financial fraud detection: Self-attention generative adversarial networks for

precise and effective identification. Finance Research Letters, 60, 104843.

[107] Zhu, K., Zhang, N., Ding, W., & Jiang, C. (2024). An Adaptive Heterogeneous Credit Card Fraud Detection Model Based on Deep

Reinforcement Training Subset Selection. IEEE Transactions on Artificial Intelligence.

AUTHOR

Dr. Hashim is an assistant professor in the Cybersecurity Dept., EMU University – Jordan. His research interests includedatabases, big data, ontologies, network security, Data Science, and image encryption.